| Rating: 4.7 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Wise Payments Ltd. |

The Wise app, formerly known as TransferWise, is a revolutionary financial platform that simplifies international money transfers and currency exchange. With its transparent fees, competitive exchange rates, and user-friendly interface, Wise has gained popularity among individuals and businesses worldwide. In this article, we will delve into the features, benefits, pros, and cons of the Wise app.

Features & Benefits

- Low and Transparent Fees: One of the standout features of the Wise app is its low and transparent fees. Unlike traditional banks and money transfer services that often charge hidden fees and unfavorable exchange rates, Wise offers transparent pricing, with fees clearly stated upfront. This allows users to save money and have full visibility into the costs associated with their transactions.

- Competitive Exchange Rates: Wise provides users with highly competitive exchange rates, often beating those offered by banks and other financial institutions. By offering mid-market rates and minimal markups, Wise ensures that users receive more value for their money during currency conversion.

- Fast and Convenient Transfers: The Wise app enables swift and hassle-free international money transfers. With its extensive network of local bank accounts in multiple countries, Wise can facilitate local transfers, significantly reducing the time and complexity typically associated with cross-border transfers.

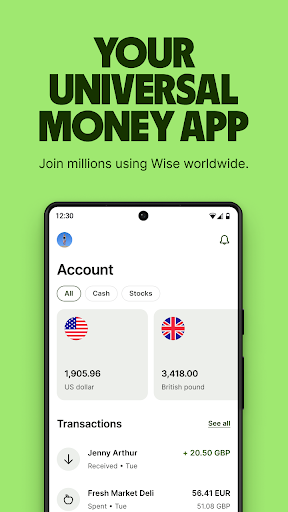

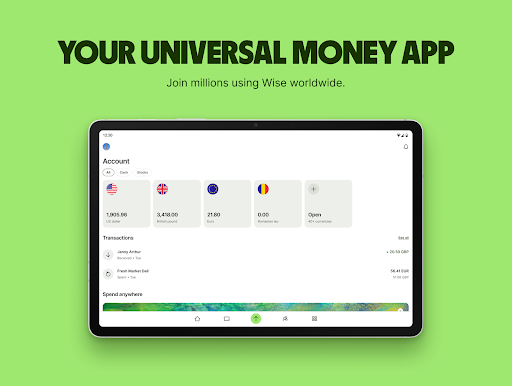

- Multi-Currency Account: Wise offers users the convenience of a multi-currency account, allowing them to hold and manage funds in various currencies. This feature is particularly beneficial for individuals or businesses that frequently transact in different currencies, as it eliminates the need for multiple bank accounts and simplifies currency exchange.

- Business Solutions: In addition to serving individual users, Wise provides robust solutions for businesses. The Wise Business platform offers features like mass payouts, batch payments, and integration with accounting software, making it an efficient and cost-effective option for businesses managing international payments.

Pros & Cons

Wise Faqs

To verify your identity, open the Wise app and go to the “Profile” section. You’ll need to provide personal information such as your name, address, and date of birth. The app may also ask for a government-issued ID and a document that proves your address, like a utility bill. Make sure your documents are clear and legible. Once submitted, verification typically takes a few minutes, but it can take longer during peak times. The Wise app allows you to hold over 50 different currencies in your account, including major ones like USD, EUR, GBP, AUD, and JPY. You can easily manage multiple currencies, making it convenient for international transactions. To see the complete list of supported currencies, navigate to the “Balances” section in the app. Yes, Wise charges a small fee for sending money internationally, which varies depending on the currency pair, the amount, and the payment method you choose. The app displays a transparent breakdown of all fees before you confirm a transaction, so you’ll know exactly what you’re paying. Generally, Wise is known for lower fees compared to traditional banks. Security is a top priority for Wise. The app uses advanced encryption technologies to protect your data and transactions. Additionally, Wise is regulated by financial authorities in various countries, ensuring compliance with stringent safety regulations. Two-factor authentication (2FA) is also available, adding an extra layer of security to your account. Absolutely! With the Wise app, you can receive payments in multiple currencies through its local bank details feature. This provides you with local bank account details in different countries, allowing you to receive funds without incurring conversion fees. Just share your local account details with the sender, and they’ll be able to transfer money directly to your Wise account. If you experience any issues, first check the ‘Help Center’ within the app for troubleshooting guides and answers to common questions. If the problem persists, you can contact Wise’s customer support through the app under the “Help” section. They usually respond promptly and can assist you with any technical or transactional issues you might face. Yes, Wise offers features tailored specifically for businesses, including multi-currency accounts and bulk payment capabilities. Businesses can take advantage of competitive exchange rates and low fees for international transactions. You can sign up for a business account directly through the app and access all the necessary features designed for managing company finances globally. To close your Wise account, you need to ensure that there are no pending transactions and that your balance is zero. Then, go to the “Profile” section in the app and select “Close Account.” Follow the prompts to confirm the closure. Your account will be closed, and all associated data will be securely deleted according to Wise’s privacy policy.How can I verify my identity on the Wise app?

What currencies can I hold in my Wise account?

Are there fees for sending money internationally using Wise?

How does the Wise app ensure the security of my transactions?

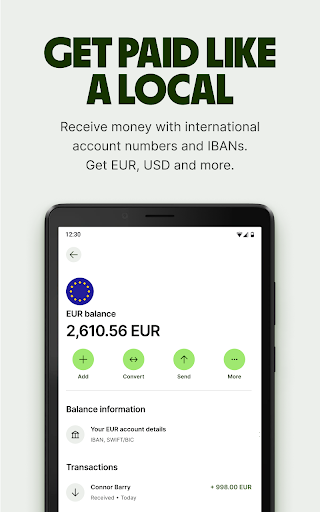

Can I receive payments in foreign currencies using the Wise app?

What should I do if I encounter an issue while using the Wise app?

Is it possible to use the Wise app for business transactions?

How can I close my Wise account if I no longer need it?

Screenshots

|

|

|

|